U.S. stock futures rose in early trading Wednesday night as markets try to build on recent strength in the Dow Jones Industrial Average and S&P 500.

The two indexes have just posted their first back-to-back gains since February. Fueling the rally is the hope that the White House and Senate will soon agree to a stimulus package to prop up markets as the coronavirus outbreak rages on.

Dow futures rose 251 points, indicating a gain of 197 points, or 1%, at the open. The S&P 500 and Nasdaq were also slated to open roughly 1% higher.

On Wednesday, the Dow climbed more than 2%, or 495.64 points to close at 21,200.55. Boeing and Nike fueled the 30-stock index, rising 24% and 9%, respectively. The S&P 500 also registered a gain, climbing 1.1%. The Nasdaq Composite was the relative underperformer, dipping 0.5% as Facebook, Amazon, Apple, Netflix and Google-parent Alphabet all closed lower.

Stocks rallied for much of the day after the White House and Senate agreed on a $2 trillion coronavirus stimulus bill early Wednesday morning. But a tweet from Sen. Bernie Sanders coming late in the day suggested the bill could hit a few snags before a final vote. That sent stocks tumbling from their session highs. Before the tweet, around 3:30 p.m. ET, the Dow had been up 1,315 points, or 6.35%, while the S&P rose as much as 5.07%.

Wednesday’s gains extended Tuesday’s historic rally, which saw the Dow register its best day since 1933 and post its largest single-day point gain in history. Tuesday was the S&P 500′s best day since 2008.

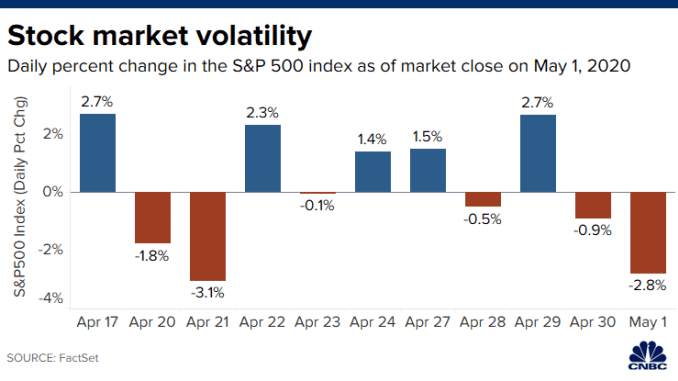

In what’s been a bout of extreme volatility for the market, this was the first time the indexes managed to post back-to-back gains since February.

“It was great to see the stock market finally rally for a second day in a row, but late day ‘fade’ was obviously disappointing,” said Miller Tabak chief market strategist Matt Maley. “As disappointing as the late day decline was, it merely confirmed what we already knew … bottoms after severe declines in the stock market are formed in a ‘process’ and are rarely V-shaped,” he added.

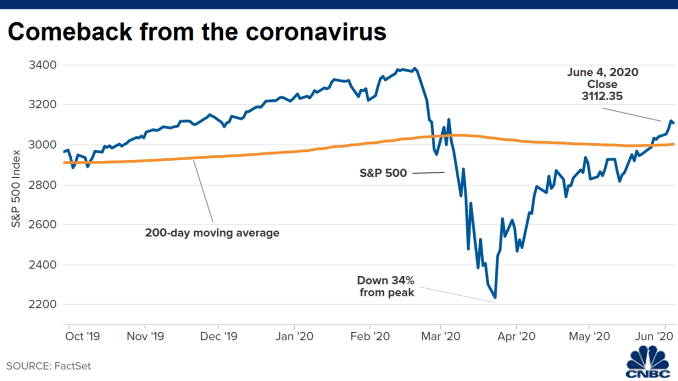

Despite the gains, the major averages still have a lot of ground to make up for before returning to record highs. The S&P 500 is 27% below its February all-time high, while the Dow is trading 28.3% below its record.

The Federal Reserve has stepped in in an effort to shore up the economy as the coronavirus outbreak and subsequent business slowdown continues to wreak havoc on global markets. Among other things, the central bank has slashed interest rates to near zero and announced an unprecedented quantitative easing program.

Former Fed Chairman Ben Bernanke said Wednesday that current Chairman Powell has been “extremely proactive,” while noting that markets could still be in for steeper declines ahead.

“It is possible there’s going to be a very sharp, short, I hope short, recession in the next quarter because everything is shutting down of course,” he said on CNBC’s “Squawk Box.” But he did sound an optimistic note, saying that there could also be a “fairly quick rebound.”

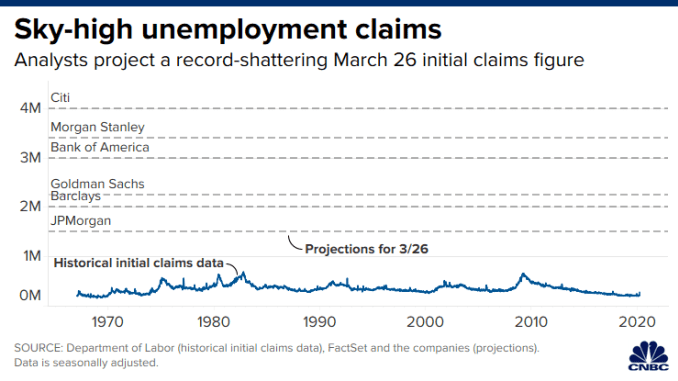

The impacts of the coronavirus are already very much being felt throughout the economy. On Wednesday California Gov. Gavin Newsom said that the state has seen 1 million unemployment claims in less than two weeks as the pandemic has led to businesses being shut down across the state.

National numbers will be released on Thursday, and Street strategists are projecting record-shattering numbers. Citi is the most bearish, with estimates of roughly 4 million claims.

Komentar Terbaru